Managing the Cost of Workers’ Compensation

How Macy's saved money on employee health with Kaiser-On-the-Job®

Nov 12, 2014

California is home to some of the nation’s highest workers’ compensation costs. A number of factors drive up the price of care delivery — from the state’s higher cost of living to increased rates of litigation. And since 2005, the average cost of a workplace injury has risen 58% — from about $57,000 to almost $90,000 — making it harder for businesses to remain competitive and function at their best.1

For a company like Macy’s Inc., with 30,000 employees and nearly 150 retail locations in California, finding an effective occupational health partner could have a huge impact on their business. The retailer has a high concentration of its workforce in Southern California, where the cost of care delivery is especially high. Average medical costs for claims in Los Angeles are up to 36% higher than in other parts of the state.2

To combat those forces, they needed a partner to:

- Deliver high-quality care to injured or ill employees.

- Help those employees get back to work sooner.

- Reduce the number of claims that involve litigation.

- Drive workers’ compensation costs down.

A strong partnership for superior results

With nearly 50 facilities throughout California, Kaiser On-the-Job® was a natural fit for Macy’s. It gave their employees the flexibility to take advantage of our high-quality occupational health care, even if they weren’t already members of a Kaiser Permanente health plan. Most Kaiser On-the-Job facilities are located on or near Kaiser Permanente hospital campuses, offering convenient access to specialists, pharmacy, X-rays, physical therapy, and more — under one roof. This makes it easier for employees to get the care they need, so they can get back to work more quickly. And our physicians, nurses, care coordinators, and therapists all specialize in the unique challenges of work-related injuries.

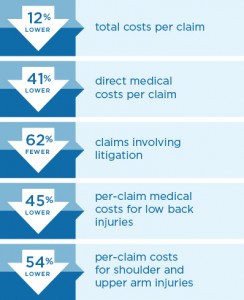

A yearlong study showed that Kaiser On-the-Job delivered considerable savings to Macy’s. Direct medical costs were lower across the board, regardless of the injury. And significantly fewer claims involved litigation when treatment was provided by Kaiser On-the-Job compared to other providers.3

Compared to other occupational health services for injured Macy’s employees, care from Kaiser-On-the-Job® resulted in:

— MedMetrics, 2013.

We’re able to achieve these outcomes because of our integrated model and commitment to evidence-based medicine. We’re able to easily share current clinical guidelines supported by the latest research throughout our regions — and swiftly apply best practices so employees can return to work when appropriate. That’s the way we coordinate and standardize the quality of care across our Kaiser On-the-Job facilities.

No company is immune from workplace injuries or illnesses. But the right partner can help protect your business from the threat of increasingly high costs — and give you peace of mind that your employees are getting the high-quality care they deserve.